Regarding real estate, timing might mean the difference between snagging your ideal home and seeing it pass you by. Buyers who are able to handle the early stages of a project tend to win out as demand varies and property prices rise. An Expression of Interest (EOI) is one of the best instruments for this. EOI in real estate allows buyers to express interest in a property before formal sales begin, securing priority access to new projects and often better prices than those offered later.

But what should you know before submitting your EOI, and how does this process actually work? To ease this down, we’ll explore the definition of EOI in real estate, its significance, and how it can give you a crucial edge in a competitive market.

EOI Meaning in Real Estate?

An Expression of Interest, or EOI in real estate, is a formal statement from a potential buyer expressing interest in a particular property. It is a non-binding contract in which the buyer usually indicates their intent to purchase by submitting a small, typically refundable payment while waiting for further details such as the final floor plan, amenities, pricing, and regulatory approvals.

EOI in real estate allows developers to evaluate market demand before the project’s official launch. In return, buyers get early access to preferred floor plans, units, and often enjoy introductory pricing benefits.

Developers commonly invite EOIs during a project’s soft launch phase or while regulatory clearances are pending. This not only allows potential buyers to secure a spot in what could become a high-demand development but also helps gauge overall market sentiment.

How Does the EOI Process Work?

The fundamental steps in the EOI process usually consist of the following, though there may be minor variances based on the developer or location:

Project Announcement: Usually, in the pre-launch stage, the developer makes an announcement about a new residential or commercial project in a particular area.

Inviting EOIs: Depending on the type and segment of the property, interested purchasers are asked to fill out a form and pay a small fee (usually between ₹50,000 and ₹2,00,000) to submit an Expression of Interest.

Priority Allocation: After the project is formally announced, buyers who submit an EOI are given preference when choosing units.

Refundability Clause: The EOI payment is often returned without penalty if the buyer decides not to proceed with the reservation after launch information is disclosed.

Conversion to Booking: The EOI amount is applied to the booking money if the buyer is happy with the official price list, floor plan, and project details.

Also Read: FSI Full Form, Meaning & FAR Difference in Construction

Why Do Developers Use the EOI Model?

The EOI technique offers developers several strategic benefits, including:

Market Demand Validation: Before distributing marketing funds or starting full-scale launches, EOIs assist in determining actual buyer interest.

Effective Inventory Management: It helps with pricing strategy and sales projections by enabling developers to forecast demand for particular unit kinds or quantities.

Better Financing Options: A robust project pipeline is indicated by a large EOI response, which may draw institutional lenders or investors.

Customer Relationship Building: By including interested parties early on, developers can build a more customized purchasing experience.

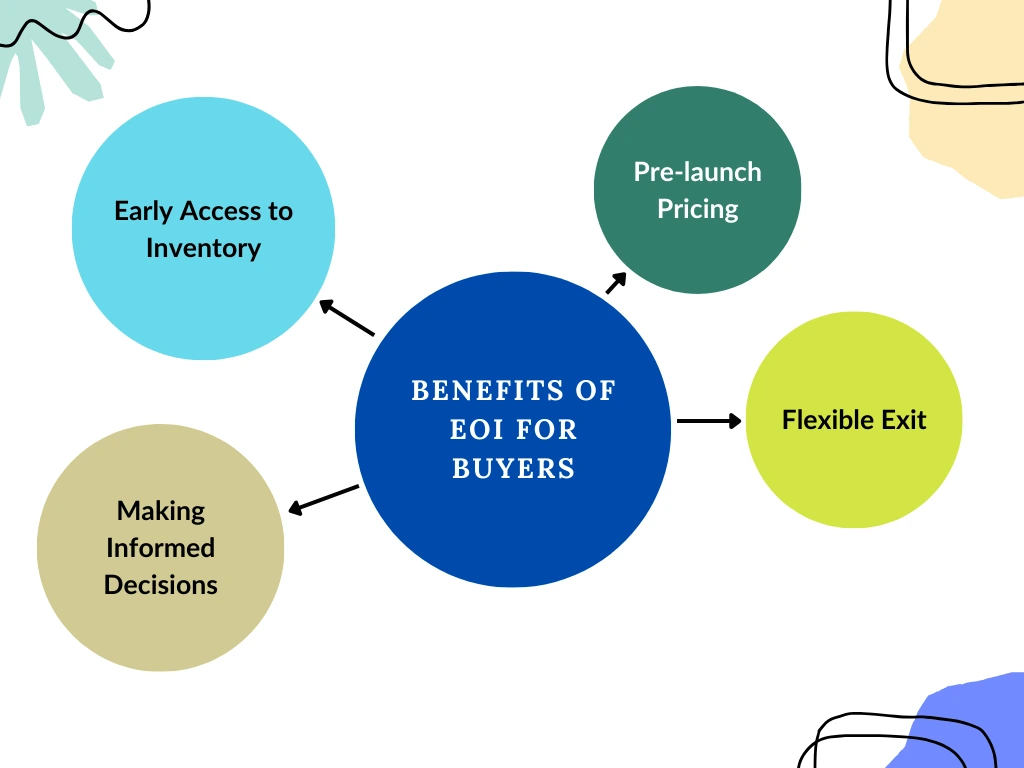

Benefits of EOI for Buyers

The EOI process offers several noteworthy benefits from the standpoint of the buyer:

Early Access to Inventory: Applicants are given first choice when choosing units, frequently including floors or vistas in a project’s ideal location.

Pre-launch Pricing: Usually, EOI participants receive special offers or discounted prices that might not be accessible after launch.

Flexible Exit: The financial risk is low because EOIs are largely refundable and non-binding.

Making Informed Decisions: Before committing fully, buyers have the opportunity to evaluate the official launch details.

Risks and Considerations Before Submitting an EOI

Despite the possible benefits of EOIs, consumers must be aware of any potential drawbacks or areas that need caution:

Refund Policy Clarity: Pay close attention to the fine print. Some developers may apply limitations or deduct processing costs, but the majority accept refunds.

Credibility of the Developer: It makes more logical to submit an EOI when the developer has a solid track record. Examine their prior work, schedules for delivery, and client testimonials.

No Legal Requirements for the Developer Either: The developer is not required to assign a specific unit or to honor all pre-launch offers if plans change, just as the buyer is not required to move forward.

Project Approval Status: Verify that the RERA registration procedure has at least been started. The developer cannot lawfully sell or market the flats without this.

Expression of Interest vs. Booking: What’s the Difference?

It’s essential not to confuse the expression of interest with a formal booking. Here’s a simple comparison:

| Feature | Expression of Interest (EOI) | Booking |

| Legal Binding | No | Yes |

| Payment Type | Token amount (₹50,000–₹1 lakh typically) | Booking amount (5-10% of property value) |

| Refundable | Yes (mostly) | Usually not |

| Purpose | To show interest before launch | To reserve a specific unit officially |

| Stage | Pre-launch or early launch | Post-launch |

So, if you’re still evaluating options or waiting for RERA registration, EOI offers flexibility, while a booking is a firm commitment.

What to Ask Before Submitting an EOI?

Before submitting an Expression of Interest (EOI), it’s essential to clarify certain details to ensure you’re making an informed commitment. Here are key questions to ask:

- Is the EOI refundable or non-refundable?

Understand whether the amount you’re paying can be reclaimed if you change your mind or the project doesn’t proceed. - What is the selection or allocation process?

Ask how units will be allocated — is it first-come-first-serve, lottery-based, or merit-based? - Will the EOI guarantee unit allocation or pricing?

In most cases, it doesn’t. Clarify this with the developer to manage expectations. - What happens after the EOI is submitted?

Confirm the next steps, timeline for launch, and how and when you’ll be contacted. - Can the terms change after submitting an EOI?

Ensure that you’re aware of any clauses that allow the developer to alter terms or pricing post-EOI.

Common Terms in EOI Documents

While EOI documents are generally non-binding, they often include certain terms that buyers should review carefully:

- Applicant Details – Name, contact, and ID proof of the person expressing interest.

- Project Information – Name, location, and basic details of the proposed property.

- Unit Preferences – Choice of unit type, floor, view, or size (if applicable).

- EOI Amount – The fee to express interest, including whether it’s refundable.

- Declaration Clause – A statement acknowledging that the EOI is not a booking or sale agreement.

- Timeline – Expected date for launch, communication, or conversion to booking.

- Refund Policy – Conditions under which the EOI amount will be refunded or forfeited.

Opportunities in real estate don’t wait. An effective way to show intent without making a full commitment is to submit an EOI. It also gives you access to early price and selection advantages. As long as you’ve done your research, it’s low risk and potentially high payoff. Understanding and properly utilizing EOIs could be a crucial competitive edge if you intend to enter the real estate market soon.