If banks were to adopt a motto when evaluating house loans, it would be “Trust, but verify.” Every figure you disclose and every form you turn in is subject to audit treatment. This makes sense because you’re requesting long-term financial trust that is supported by assets, income, and credibility rather than just a loan.

The home loan process may be more digitalized in 2025, but the essentials – eligibility checks, document review, credit score verification, and property appraisals remain the same. It’s certainly detailed, but it’s not hard.

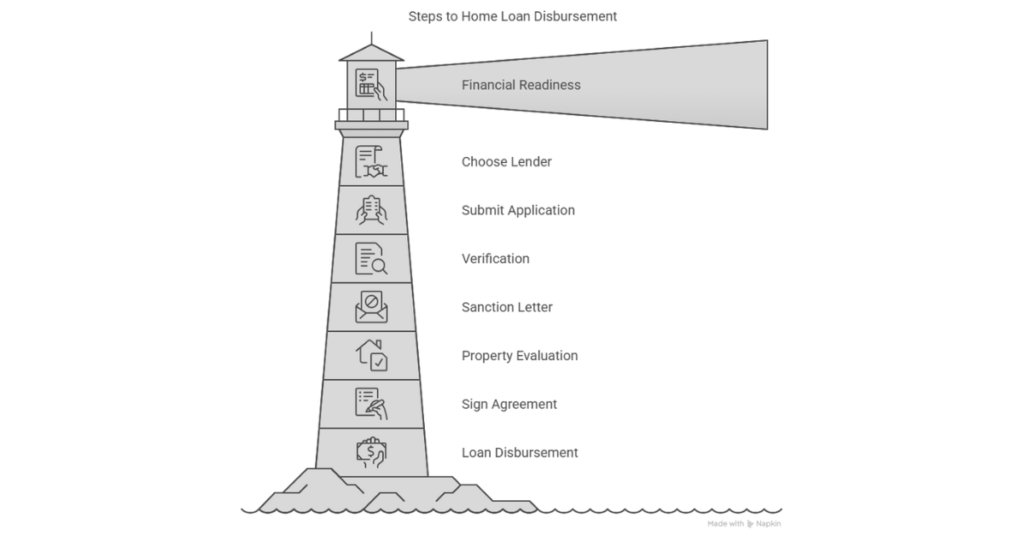

Let’s take a step-by-step look at the full home loan procedure before you commit to years of EMIs. No technical terms. No nonsense. precisely what takes place and when.

What Is the Home Loan Process?

The methodical procedures a financial institution follows to evaluate, confirm, authorize, and distribute a house loan to a borrower are referred to as the home loan process.

To put it simply, it is the process by which banks determine your loan eligibility before giving you the money to buy your home.

Let’s examine each phase of the house loan procedure in more detail.

Step-by-Step Guide for Bank Loan Process

Step 1: Evaluate Your Financial Readiness

Assessing your financial situation is crucial before approaching a bank or housing finance provider. This entails examining your monthly spending, credit score, income, and outstanding debts.

For house loan approvals, a credit score of 750 or more is usually seen as desirable. Additionally, lenders evaluate your ability to repay, typically permitting up to 40–50% of your monthly income to be used for EMIs (Equated Monthly Installments).

You can find out how much you can borrow and what kind of house you can afford by completing this initial assessment. By taking care of any financial red flags beforehand, it also increases your chances of getting your loan approved.

Read also: What is OC Certificate? OC Full Form in Real Estate

Step 2: Research and Choose the Right Lender

Choosing the correct loan is the next step after organizing your finances. Home loans are available at competitive rates from a number of banks, non-banking financial corporations (NBFCs), and housing financing firms.

When selecting a lender, evaluate:

- Interest rates (fixed vs. floating)

- Loan tenure options

- Processing fees

- Prepayment or foreclosure charges

- Customer service reputation

Because it impacts your monthly expenses and total payback experience, choosing the correct lender is an important decision. At this point, it’s critical to be clear about timescales and expectations because bank loan procedures can differ slightly between institutions.

Step 3: Submit Your Application and Documentation

You must complete a home loan application form after deciding on a lender. Additionally, send in all required paperwork, which often consists of:

- Identity proof (Aadhaar card, PAN card, passport)

- Address proof

- Income proof (salary slips, Form 16, income tax returns)

- Employment details (offer letter, employment certificate)

- Bank statements (typically for the last 6 months)

- Property documents, if already finalized

While some banks may require a branch visit, others provide online applications. Whatever the mode, thorough and accurate documentation is essential to accelerating the process.

Read also: Things to Check Before Buying a Flat in Bangalore

Step 4: Verification and Background Checks

At this point, a comprehensive home loan verification procedure is carried out by the lender. It consists of:

- Confirming your identity and work information

- Examining your credit report

- Evaluating your earnings and debts

- Verifying the legitimacy of the documents submitted

For further confirmation, a bank representative may frequently additionally come to your home or place of employment. This phase aids the lender in determining your creditworthiness and ability to repay.

Step 5: Issuance of the Sanction Letter

Upon successful verification and lender approval of your application, you will receive a letter of home loan sanction. In this document, we describe:

- The sanctioned loan amount

- Interest rate and type

- Loan tenure

- EMI details

- Terms and conditions of the loan

The sanction letter shows that the bank is willing to grant you a home loan based on your existing eligibility; it is not the final loan agreement. To continue, you need to sign the letter and send it back to the bank.

Read also: Top 5 Posh Areas in Bangalore for Luxury Living in 2025

Step 6: Legal and Technical Property Evaluation

The lender starts the process of confirming the property you want to buy as soon as the sanction letter is accepted. Two important checks are included in this:

Legal Check: To validate ownership, look for any conflicts, confirm government approvals, and make sure the property is free of encumbrances, a group of legal professionals examines the property documentation.

Technical Evaluation: The property’s physical state is examined by a bank valuer or civil engineer. They guarantee that the building is structurally sound, that the construction follows approved blueprints, and that the claimed price is in line with industry norms.

These assessments guarantee that the property is a secure investment for the lender and you.

Step 7: Signing the Loan Agreement

You will be allowed to sign the final home loan agreement following the completion of all legal and technical procedures. This legally enforceable document consists of the following:

- Detailed terms of the loan

- Repayment schedule

- Interest obligations

- Clauses on default and penalties

It is important to carefully read the agreement. Before signing, make sure you understand all the terms by speaking with a legal expert if necessary. You are legally obligated by the loan’s terms after you sign it.

Read also: Bank Rate vs Repo Rate: Simplifying India’s Key Financial Indicators

Step 8: Disbursement of the Loan Amount

The house loan payout process is the last phase. At this point, the bank gives the builder or seller the approved loan amount. Two methods of disbursement are available:

Complete Disbursement: The entire loan amount is paid out all at once if you are purchasing a home that is ready for occupancy.

Partial or Progressive Disbursement: When it comes to properties that are still under construction, the bank delivers the funds in stages according to the builder’s request and the status of the project.

Instead of going to the borrower, the money is typically disbursed by check or direct transfer to the seller’s or builder’s account.

How Long Does the Home Loan Approval Take?

The approval time for house loans is a question that many applicants have. Approval times might range from three days to two weeks, although they rely on the lender and the intricacy of the case.

The overall turnaround time is influenced by a number of factors, including bank procedures, property type, credit score, and document completeness.

While private lenders frequently claim quicker processing yet have more stringent eligibility requirements, public sector banks may take a little longer due to procedural regulations.

How to Get a Home Loan from a Bank?

Still, wondering how to simply obtain a home loan from a bank? Here are some useful pointers:

- Keep your credit score high.

- Cut down on current debt and EMIs

- Maintain all documents current and available.

- Examine options before choosing a loan.

- Respond to the lender’s inquiries.

- Select properties with legally valid titles.

Your chances of having a loan authorized swiftly and easily might be greatly increased by following these procedures.

Wrapping Up

In 2025, applying for a home loan is easier and more digital than it was ten years ago. The home loan process is quicker and more transparent with the availability of mobile apps, internet resources, and instant credit checks. Nevertheless, each stage from the eligibility check to the last payout needs careful consideration and prompt action.

You may take a confident step toward house ownership, prevent delays, and lessen stress by being aware of the entire process and being organized.

Therefore, adhering to this methodical approach to the house loan procedure will assist you in making well-informed selections and guarantee a more seamless experience, regardless of your plans to purchase your first apartment or invest in a second residence.